【楼市】澳洲将面临长达十年的住房紧缩、楼市中长期展望

澳大利亚现正面临住房供应紧缩,新的需求将在几年内再次超过供应,即供不应求。

政府专家住房顾问的最新国情报告强调了对供给侧政策进行改革的必要性,并支持澳大利亚储备银行行长 Philip Lowe 的观点,即解决供应瓶颈是未来几年保持房价稳定的关键因素。

No.1

净移民

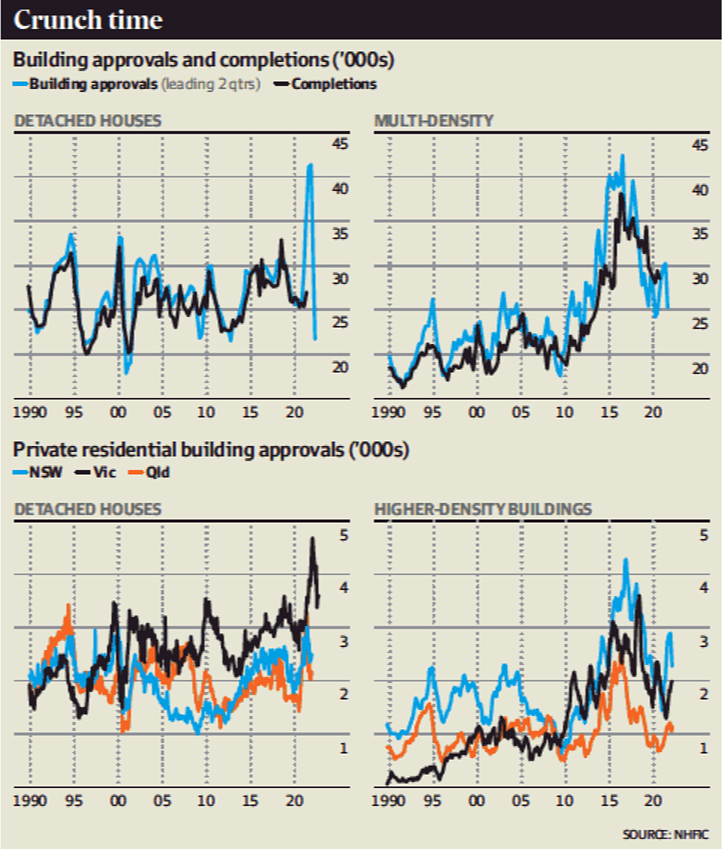

根据国家住房金融和投资公司 (NHFIC) 的数据,在政府大规模刺激措施和创纪录的低利率的推动下,住房建设在大流行期间蓬勃发展,而海外净移民出现大约一个世纪以来首次倒退。

在 2021-22 至 2022-23 年间,每年将增加近 120,000 套独栋屋和 66,000 套中等密度公寓房,但 NHFIC 表示这是最低需求。

“我们预计,从现在到 2024 年,住房供应将保持强劲,尽管随着边境重新开放和家庭形成恢复到大流行前的水平,长期的供需平衡值得关注,”高级顾问 Hugh Hartigan说。

“例如,我们预计未来三年每年将新增约 184,000 套新房(扣除拆迁),而在 2025 年至 2032 年期间,我们还预计每年将新增近 180,000 户家庭数量。”

根据 NHFIC 的国情报告,主要由单人家庭主导的家庭 - 居住在住宅中的单人或群体 - 在直至 2032 年的十年内将达到 170 万以上。

虽然在2022年新建房屋的速度超过家庭数量的形成约为115,000 户,而2023年约为 35,000 户。但此后,需求将大量增加。

到 2024-25 年,海外净移民人数将完全恢复到大流行前约 235,000 人的水平,家庭数量的形成将超过新建房屋的速度,至2032年,供应短缺约超过 163,400。

NHFIC 说:“到 2024-25 年,家庭形成和对空置住宅的需求预计将略高于建筑活动,这看起来可能会保持现状,直到 2030-31 年。”

No.2

短缺

主要短缺将来自公寓房,这些公寓房将面临新移民的需求增加以及利率上升带来的缩减。

NHFIC 的模型假设澳大利亚储备银行过去对现金利率的前瞻性指引将保持在目前的创纪录低点 0.1%,直到 2024 年,这种情况现在不太可能发生。

本月早些时候,澳大利亚央行行长 Philip Lowe 表示,该行已将其预期至少提前了 12 个月,货币政策紧缩周期可能会在今年晚些时候“合理地”开始。

NHFIC 表示,其业务联络计划的反馈表明,绿地供应不足阻碍了独栋屋的建设,而审批缓慢阻碍了多住宅的开发。“开发审批过程漫长而繁琐。在某些情况下,从提交中等密度和公寓开发申请到施工完成需要六年时间。报告称,预计未来两到三年内多单元竣工量将出现短缺,尤其是现在租赁市场已经趋紧,随着国际边界的重新开放,需求将会增加。”

这将在中期内给房价增加压力。 2021 年,澳大利亚首府城市的房价平均上涨了 23%。经济学家预计今年将继续增长,然后在 2023 年和后年回落,而年度新增供应量将超过新增需求量。

近年来价格强劲增长是由低利率和政府补贴推动的,这些补贴有助于缓解一些被压抑的需求,例如试图进入市场的首次购房者排长队。根据 NHFIC 的说法,投资者拥有的物业被出售给了首次购房者。

对独立住宅的强劲需求也意味着非公寓的价格上涨。

原文:

Australia is heading for a housing supply crunch despite the population taking a major dent due to the COVID-19 crisis, with fresh demand set to again outpace supply within a few years.

The latest State of the Nation report from the government’s expert housing advisers highlights the need for reforms to supply side policies and backs Reserve Bank of Australia governor Philip Lowe’s view that fixing supply bottlenecks is a key element of keeping house prices stable in coming years.

Fuelled by massive government stimulus and record-low interest rates, housing construction boomed during the pandemic while net overseas migration went backwards for the first time in about a century, according to the National Housing Finance and Investment Corporation (NHFIC).

Almost 120,000 detached homes and 66,000 medium-density units will be added to housing stock each year between 2021-22 to 2022-23, but NHFIC said this is the bare minimum needed.

‘‘We expect a strong pipeline of housing supply from now until 2024, though it’s worth keeping in perspective the longer-term balance of supply and demand, as borders reopen and household formation resumes to pre-pandemic rates,’’ senior adviser Hugh Hartigan said.

‘‘For example, we expect around 184,000 new homes per year (net of demolitions) to add to supply in the next three years, while between 2025 and 2032 we also expect almost 180,000 new households to form each year.’’

Household formation – the number or single or groups of people that live in a dwelling – will hit more than 1.7 million in the decade to 2032, according to NHFIC’s State of the Nation report, led largely by single-person households.

New home builds will outpace household formation by more than 115,000 in 2022 and 35,000 in 2023, but that’s where the good news ends.

With net overseas migration set to fully recover to pre-pandemic levels of about 235,000 by 2024-25, household formation is expected to outpace new housing supply by a cumulative 163,400 to 2032.

‘‘By 2024-25, household formation and demand for vacant dwellings is expected to slightly exceed construction activity, which looks likely to remain the status quo until 2030-31,’’ NHFIC said.

The main shortfall will come from units, which will face increased demand from new arrivals a well as downsizing brought on by higher interest rates.

NHFIC’s modelling assumes the Reserve Bank of Australia’s past forward guidance for the cash rate to remain on hold at the current record low 0.1 per cent until 2024, a scenario that is now very unlikely.

RBA governor Philip Lowe earlier this month indicated the bank had brought forward its expectations by at least 12 months, and a monetary policy tightening cycle could ‘‘plausibly’’ begin later this year.

NHFIC said feedback from its business liaison program indicated inadequate supply of greenfield land was holding back detached dwelling construction, while slow approvals was hindering multi-dwellings developments. ‘‘The development approval process is long and cumbersome. In some instances, it takes six years from when a medium-density and apartment development application is lodged to when construction is completed. A shortage of multi-unit completions is expected in the next two to three years, especially now the rental market is already tightening, and demand will lift as international borders reopen,’’ the report stated.

That will add pressure to house prices over the medium term. In 2021 prices increased 23 per cent on average across Australia’s capital cities. Economists expect growth to continue this year before falling back in 2023 and the year after, while annual new supply exceeds new demand.

Strong price growth in recent years was driven by low-interest rates and government subsidies that helped alleviate some pent-up demand, such as a long-line of first homebuyers trying to get into the market. According to NHFIC, stock owned by investors was offloaded to first homebuyers.

Strong demand for detached dwellings also meant there was price growth in the non-apartment section.

+61

+61 +86

+86 +886

+886 +852

+852 +853

+853 +64

+64